Your business could be growing on someone else’s dime, and it’s not exactly charity. While traditional funding methods like loans and investments are well-known, grants offer a unique and often overlooked opportunity. This article will explore the compelling reasons why your business should seriously consider applying for grants and how they can be a catalyst for your company’s success.

Understanding the Grant Landscape

What Are Business Grants?

Business grants are financial awards given to companies by government agencies, private foundations, or corporations. They are often referred to as Request For Proposals (RFP) or solicitations. They will require you to perform a task, do some research, or host an event and report how the money is being used. And unlike loans, grants don’t need to be repaid, making them an attractive option for businesses looking to fund growth or specific projects.

Types of Grants Available

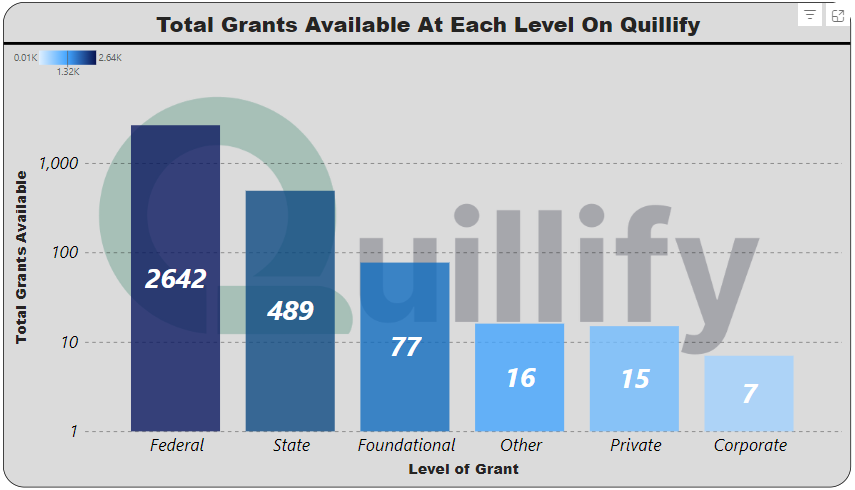

There are trillions of dollars available to small businesses, nonprofits, native american organizations, researchers, governments, and more every year. They come from thousands of sources. Let’s go through which groups are giving out grants.

Government Grants

Federal, State, and Local governments are all giving out grants for businesses. There are almost 30 branches of the federal government giving out grants through their various initiatives and groups. The most popular federal grant for for-profit businesses is the Small Business Innovation Research (SBIR) program which gives up to $2 million in grant funding for initiatives that have potential for commercial impact and dual-use applicability. To get these grants you typically need someone with an advanced degree on the team applying to the grant. You can learn more about SBIR grants at https://sbir.gov. Organizations can only acquire one federal grant for equivalent initiatives at a time according to the law.

At the state level, each branch of state government gives out grants as well. However, State funding often comes from them acquiring a federal grant and redistributing it. Other times, state-level grants come out because of a surplus in budget for the fiscal year. Each state department and each state has a unique way of announcing the grant opportunity and accepting applications. Ask around for the typical release and close date for your state’s grants.

At the local government level, the line between grants and contracts is fairly blurred and there is no standardized way local governments inform their businesses about these opportunities. To learn how your local government does it, attend a city hall meeting. Local governments similarly acquire federal or state grant funding to redistribute it.

Private Sector Grants

Large organizations around the globe hand out grants, the largest being corporations and nonprofit foundations. As a part of corporate giving programs or as a marketing incentive, corporations will give out small grants, typically no more than $10,000 to individuals or organizations that impress them.

For the foundation grants, they typically have a large endowment which provides investment dividends. Those dividends are then allocated every year as grant opportunities. The mission of the foundation is unique and these grants are often never announced publicly nor do they get any level of publicity. Additionally, due to tax benefits, most foundations only give to 501c3 nonprofits. To obtain these grants, it’s important to show how your project will further the foundation’s mission.

Private sector grants are the most nonstandard, hard-to-find grant opportunities. But unlike federal grants, businesses can acquire as many private sector grants as they like. This makes them an attractive supplement to business operations and federal grant opportunities.

Industry-Specific Grants

While those are the two groups of grant funders, the majority of grants are given to accomplish industry-specific tasks or promote some achievable outcome. Some of the main categories of industry grants are technology and innovation grants, green business grants, and minority-owned business grants. To give you an idea of how extensive the opportunities are, there are grants for farmers, grants for manufacturers, grants for researchers, grants for minorities, grants for construction, and even grants for helping others get grants. So if you’re wondering if there are grants out there for someone as niche as you, the answer is very likely yes.

The Benefits of Grant Funding

Financial Advantages

No Repayment Required

Unlike loans, grants are vehicles meant to promote economic prosperity and innovation free-of-charge. As long as you can be creative and execute on cutting edge projects, you can improve your cash flow without increasing any financial obligations, putting your business years ahead of your competition.

Preserve Equity

Grants only require that you execute on your project and be efficient with your money. This allows your business to grow without diluting ownership

Supplement Other Funding Sources

Grants can de-risk financial investments fronted by either an investor or your own business’ financial reserves. In fact, new venture capital investors are beginning to consider a grant-funded business as an investment more likely to win than one that is not suitable for grants.

Beyond the Money

Credibility Boost

Funders spend a lot of resources vetting the commercial need for certain products or programs. Thus, if you get a grant, you are almost guaranteed to be working toward solving a big problem with a large market. Furthermore, funders are a type of local influencers, so getting their financial stamp of approval goes a long way with gaining or partnering with enterprise clients.

Networking Opportunities

Many grants offer additional access to resources that can boost your business such as mentorship, networking events, workshops, and more. Working with funders can lead to enhanced industry connections as they open their network to the valuable work you are doing for them.

Forced Strategic Planning

To get a grant, you must first make a robust plan explaining what you will do, why it is important, how it will improve outcomes ongoing, who will be executing it, why they are the right fit, and what you’re spending the money on. This by nature forces businesses to refine their business strategy, have clear goals and growth plans, and understand their market position before diving into business development. Writing a grant has historically been a complex process, with federal grants being the most difficult and private sector grants being the most simple, but with modern tooling finding and writing grants can be extremely simple.

Real-World Impact: Success Stories

Case Study: Quillify

Quillify, a startup developing AI technologies to simplify the grant process, began their business by applying to a $275k federal grant It took 14 months to do it manually. Concurrently, they developed a grant finding system with grant alerts. 8 months later, the Department of Defense came out with a $2 million grant for a small business to use AI to simplify the RFP process. Using their own platform, Quillify only needed 50 hours to complete the application to this large SBIR grant and received the funding they needed to cross the valley of death. This funding allowed them to complete product development and secure their first major contract, leading to a 500% revenue increase within two years.

Statistical Evidence

- A study by the National Science Foundation found that small businesses that received SBIR grants were 19 times more likely to achieve market success compared to those without grant funding.

- According to the SBA, businesses that utilize grants in their early stages have a 93% higher chance of surviving past the crucial five-year mark.

Addressing Common Concerns

“The Application Process is Too Complex”

While grant applications can be detailed, the potential reward often justifies the effort for many companies. Many organizations offer free resources and workshops to help with the application process. Quillify is the only company that makes grants as simple as possible, requiring the least amount of effort for businesses to succeed.

“My Business Won’t Qualify”

Grants exist for businesses of all sizes and across various industries. There is so much diversity in grant opportunities which means there’s likely a fit for your specific situation. The easiest way to see if there are grants for you is to purchasing a Quillify grant discovery report. You can also take our eligibility quiz to determine your grant readiness.

“The Competition is Too Fierce”

While competition can be high, funders indicate that over 70% of applicants are not qualified in the first place. Quillify finds the grants you’re qualified for eliminating this issue and helping you succeed. Additionally Quillify helps you tailor your application to the specific grant criteria, significantly increasing your chances.

How to Determine if Grants Are Right for Your Business

Self-Assessment Questions

- Do you have a clear, innovative project or growth plan that aligns with grant objectives?

- Are you willing to invest time in researching and applying for grants?

- Can your business benefit from the non-financial aspects of grants, such as mentorship and networking?

- Do you have the capacity to manage and report on grant funds effectively?

Steps to Get Started

Research Available Grants

You can try to be cheap and use free resources like Grants.gov for federal opportunities or search through google. But on average you will spend 3 to 12 days with a 3% success rate. Using Quillify, we guarantee 60% in under an hour. You can also check with your local Small Business Development Center for regional grants.

Assess Your Eligibility

Each grant opportunity will have specific eligibility criteria. Before applying to any grant always read the criteria to ensure you are a eligible and be honest about your business’ fit with the grant (and funder’s) objectives.

Prepare Your Documentation

Identify which relationships you can leverage to get letters of support or commitment. Waitlist signups or existing sales documentation are also great ways to get an edge when applying to grants. Your team’s and business’ credentials help you stand out and give credibility to the likelihood that your effort will make a difference.

Start Small

Private sector grants are the easiest to fill out while federal grants are the most complex. Consider hiring an expert to walk you through your first grant or target the small grants to get familiar with the language and requirements. You can sometimes get feedback from funders to improve your future submissions.

Pro Tip: Leverage Technology

Consider using grant software like Quillify to streamline your application process and keep track of deadlines and requirements. This can significantly increase your efficiency and success rate in applying for multiple grants.

Conclusion

Grants offer a unique opportunity for small businesses to access funding, gain credibility, and accelerate growth without the burden of debt. While the application process may seem daunting at first, the potential benefits far outweigh the initial effort. By considering grants as part of your funding strategy, you’re opening doors to not just financial support, but also valuable resources and opportunities that can propel your business forward.

Next Steps

Ready to dive deeper into the world of business grants? In our next article, we’ll guide you through “How to Start Researching Grants for Your Business,” providing you with practical steps to begin your grant journey.